Victorian Energy Efficiency Certificates (VEECs)

The success of commercial lighting continued to weigh heavily on the VEEC price across August with strong submission numbers continuing to impact the market. The softening VEEC price has already impacted significantly on the residential giveaway model and it now appears that it has done the same for commercial, with only forward contracts keeping it alive.

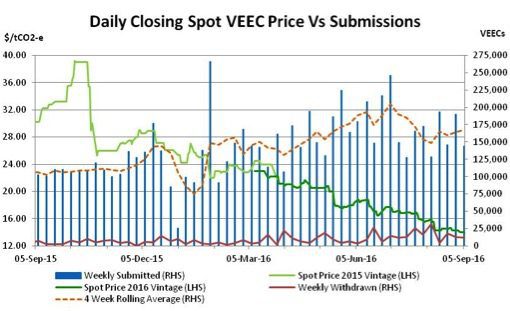

The decline in VEEC prices across 2016 has been stark and generally consistent. While the market initially found some support in the early part of August, ultimately the month was no different. Having closed July at $15.90 the spot market softened progressively across the early part of the month trading down to $15.50 before the market enjoyed a brief recovery back up to a high of $16 early in the second week. The positive sentiment however was not sustained with the market then softening sharply into the low $14s by the middle of the month. Whilst buying support again returned it was not enough to stop the spot market from closing August at $14.25, a drop of 10% on July’s close.

The softening prices are clearly a reflection of the continuing strength in VEEC submission numbers which averaged 164k across August. In terms of the number of VEECs already in the system (registered and pending registration), the 2016 target was met early in August. While it is likely the weekly VEEC submission figure will fall across the remainder of the year, it appears unlikely that the surplus rolled over from the 2016 compliance year will be less than 3.5m (roughly 60% of the 2017 target) and it may well be considerably higher.

A major point of discussion at present is the impact of softening prices on the giveaway business model for lighting. That the giveaway model is seriously under threat from falling prices does not mean that VEEC submissions will immediately fall substantially.

The main reason for this is the millions of forward VEECs that have been contracted at higher prices across the remainder of this year and into early next year. Yet with each passing month there are fewer and fewer of those, which will increasingly force creators to move away from a giveaway model and instead begin charging customers for their installs.

Such an approach may very well work for some, but it is clearly a far more challenging prospect for sales teams. There are differing views on how many VEECs the commercial lighting market is likely to be able to produce on a co-contribution basis, yet most concede it will be dramatically less than the hefty numbers pumped out over the last 8 months. Combine this with the already considerable drops in residential activity and it’s possible that some inroads will be made on the oversupply that will be produced by the end of this year.

The waters are also muddied by the introduction of Schedule 34 non building based lighting upgrades (aka street and public lighting) which happened in early August. Many of the opportunities under this methodology will involve councils – who are likely to be prepared to contribute towards the upgrades – thus potentially contributing to VEEC supply into the future, even if prices remain low.

This type of lighting has been classified under a subsection of Schedule 34 (34 NBB) and all creators need to reapply for approval to create under it whilst also needing to have all products approved again specifically for this methodology. What this means in practice is that there is unlikely be much activity under Schedule 34 NBB before early next year.

At the heart of whether the VEEC market is likely to recover over the next 12 months therefore is the size of the surplus built up over the coming months and what rate of creation the market can manage under a co-contribution model moving into next year. Across the coming 6 months participants will continue to ponder these questions.

New South Wales Energy Savings Certificates (ESCs)

The impact of a crackdown on compliance and the delays in audit times owing to the introduction of retrospective measures continued to impact on the ESC market in August. While ESC registrations remained low, the forward market was nonetheless active.

The spot ESC opened the month at $24.75 before strengthening to a high of $$25.75 mid month. The strengthening appeared to be a reflection of both the lack of ESCs being registered as well as concerns about further delays in audit times leading sellers to hold onto what they had to meet forward settlements. The spot ultimately softened across the second half of August to end the month at $25.00.

The forward market was particularly active across the month with plenty of activity for deals with settlement across the mid to latter part of next year, at modest or no escalation above the spot. As the spot market strengthened the forward curve went into backwardation, trading below the spots, highlighting the relative shortage in the near term.

With IPART attempting to ensure the integrity of the $5/MWh minimum payment rule, which requires a payment by the customer of $5 per MWh of energy saved, audit times under the scheme have blown out. Coinciding with these changes has been a marked reduction in the number of ESCs approved in recent months. From a weekly average across the first 6 months of the year of 76k, the last 2 months have seen an average of only 28k.

Many believe this considerable drop to be the result of creators being stuck in protracted audits and thus unable to register ESCs as a result. There are some however, who argue that much of the ESC creation across the back end of last financial year was part of a backlog of jobs that will not be repeated this year and that ESC registrations will be lower across the remainder of the year, not least because of the increased compliance introduced around the $5/MWh rule.

Whatever the case the next 4-6 weeks should provide the answers with either creators emerging from audits and registering large numbers of ESCs or approvals remaining at subdued levels implying things have changed.

Marco Stella is Senior Broker, Environmental Markets at TFS Green Australia. The TFS Green Australia team provides project and transactional environmental market brokerage and data services, across all domestic and international renewable energy, energy efficiency and carbon markets.