Victorian Energy Efficiency Certificates (VEECs)

Regardless of any price changes, February in the VEEC market was always set to be an important period for the observation of VEEC submission numbers with the cut-off date for installation under the old commercial lighting rules taking effect on 31st January.

The results were somewhat surprising. Meanwhile the industry is looking to the Victorian Coalition to clarify its position on the VEET ahead of the looming state election.

With the cut-off date for installation under the old commercial lighting rules taking place on 31st January, a strong incentive existed for all installers to have jobs completed by that date to avoid losing 10 or 15% of the associated VEECs by rolling over into the first phase of the discount factor changes (10% for T8 and T12s and 15% for high intensity discharge lamps).

As a result, in the ensuing weeks across February it was expected that submission numbers would be strong as the rush to install was followed by the subsequent upload of all those VEECs. What ultimately transpired was at best a mixed bag.

An initially strong week which encompassed the 31st January cut-off date for 2017 certificate eligibility saw close to 200k uploaded, though most of that took place before that date implying it was likely those trying to get in to ensure 2017 vintage VEECs.

In the three weeks that followed across February the average weekly submissions were only 123k, a considerable reduction on the weekly average seen over the last 3 months of 2017 (155k).

To some, this is a sign that VEEC supply is set to fall further, especially once the second phase of discount factor changes (20% for T8 or T12s and 30% for high intensity discharge lamps) kick in on the 1st of May.

There are others however that believe it is still too early to tell whether this reduction is an accurate indication of the current level of activity taking place or if instead it is just a fluctuation coming as a result of random (or strategic) installer behaviour.

To provide some context to the numbers, ignoring the (not unimportant) fact that there are now sufficient VEECs in the system to meet the 2018 target of 6.1m, that target would require 117k VEECs to be submitted each and every week between 1 February 2018 and 31st January 2019 in order to be met (without considering a liquidity float for the market).

Therefore during February the weekly submissions were still large enough that a small number of VEECs was being added to the surplus each week.

However, if the trend observed across February is to continue into March and beyond, then the market will quickly move into a position where the sizable oversupply that currently exists will be being gradually reduced each week, and that is before the second phase of changes come along.

Another way to look at it is that to get us to the end of the current phase of the VEEC scheme (which ends with the 2020 compliance year), the targets for 2019 (6.3m) and 2020 (6.5m) require roughly 83k VEECs to be submitted each and every week until 31st January 2021.

Once a liquidity float is added, say 1m surplus VEECs left over at that point, the task grows to 90k per week. Hence at the moment the market is still comfortably above that rate of creation for the time being.

The big question to be answered over the coming months will be whether the commercial lighting reductions change that calculus.

Another question that many market participants are hoping will be answered in the coming months is what position the Victorian Coalition will take to the state election coming up in November.

At the last election (2014) the then Napthine Government had a policy of repealing the VEEC scheme. Extraordinarily, after just one term, it was booted from office and hence the VEET remained.

This time around, in opposition, there are rumours that the Matthew Guy led party has been strongly lobbied to again take a policy of scrapping the scheme to the election, this time at the behest of incumbent lighting companies who have failed to capitalise on the scheme for various reasons.

In the coming months pressure will no doubt begin to mount on the opposition to declare its position and, in the event that they remain opposed, to justify that position in the context of the current wholesale electricity prices.

To market activity and the spot VEECs were largely range bound within the $22.75-$24.00 interval across February, with several momentum swings taking place during the month.

The forward market was particularly busy with monthly strips for settlement across 2018 very common, with fewer forwards for early 2019 also taking place.

For most of the month sellers were easy to come by above the $24 mark, becoming progressively less so as the market fell into the $23s and thus assisting the establishment of the trading range.

New South Wales Energy Savings Certificates (ESCs)

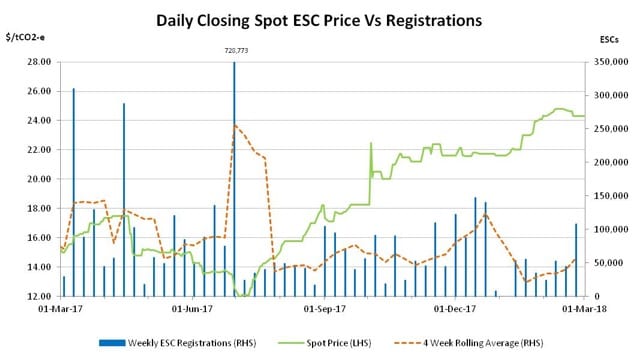

Generally low ESC registration figures helped buoy the ESC market across the first half of the month but the emergence of forward selling eventually resulted in some retracement in prices.

While there was an eventual uptick in ESC registrations, the market continues to look for further evidence of the underlying rate of activity to gauge what the next move is.

The ESC market began the month still on an upward price trajectory with the spots moving from the low $24s to a mid month high of $24.80. Along the way the forward market saw solid liquidity above the $25.00 mark for forwards across the second half of 2018 and into early 2019.

Indeed the volume traded and the prevalence of sellers was enough to halt the market’s run and ultimately turn the tide, with the spot market retreating into the low $24s across the back end of the month and the shorter dated forwards following the market down.

The focal point in the ESC market remains the registration numbers. Across most of February the figures remained persistently low, with the 4 week rolling average sitting in the 35-40k range. A solid week of 108k later in the month did lift this figure, though not substantially enough to prove definitive.

In essence what participants are trying to determine is the underlying rate of activity in the scheme which, over the last 12 months has proven particularly difficult to do based on the registration figures.

Following an uptick in late 2017, January and most of February saw a return to lower registration figures, yet many are not yet prepared to draw conclusions given the period of March through June is traditionally one of greater ESC registration activity.

As it stands there are just short of 7m ESCs available to meet the 2017 target which is likely to be just above 4m, leaving circa 2.9m ESCs already available to meet the 2018 target which is expected to total 4.3-4.4m.

To employ the same calculation outlined in the VEECs above, ignoring the current surplus, the 2018 target would warrant 84k ESCs registered each week (not including a liquidity float) for the next year. Any week in which the registration figure is below that number will result in a reduction in that surplus, while each week above it would grow the surplus.

In 2018 so far, 6 of the 7 weeks have seen registrations considerably below that figure, meaning at the moment it appears that the surplus is being progressively reduced.

Should ESC registrations not pick up, then the looming changes to the commercial lighting methodology – which are expected to be gazetted in April and take effect in October – will constitute a greater blow to future supply.

On the other hand should even a pale version of the 2017 uptick in registrations be repeated this year, then the supply demand equation could yet still change again dramatically.

Marco Stella is Senior Broker, Environmental Markets at TFS Green Australia. The TFS Green Australia team provides project and transactional environmental market brokerage and data services, across all domestic and international renewable energy, energy efficiency and carbon markets.