A raft of policy announcements, rumoured internal decisions and general economic trends are all pointing to a looming downturn in fossil exports for Australia, with many more announcements set to come in the coming months prior to the global COP26 meeting later this year.

China, comfortably one of Australia’s largest customers and a country heavily reliant on Australia’s gas exports, was recently reported by Bloomberg as issuing instructions to delay shipments of gas from Australia. This is part of an ongoing trade dispute rather than any clear climate policies within China.

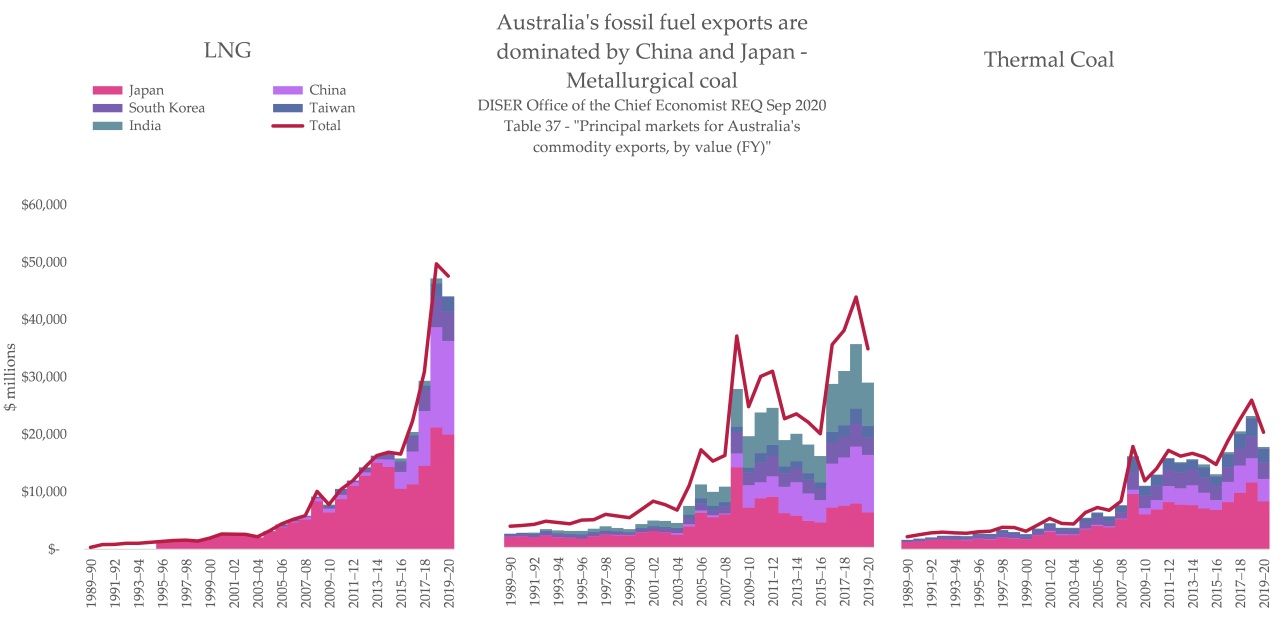

However, it highlights that Australia remains significantly exposed to this type of posturing due to its heavy economic reliance on fossil exports to China. And at the April Biden Climate Summit, China announced that it plans to “strictly control” its coal plants over the next five years, and to begin reducing coal output in China over the five years after that.

What makes this significant is it's coming straight from Xi. There are a lot of loopholes that could be introduced but unless and until that happens, officials will be very wary of signing off on new coal&industrial expansions. https://t.co/TaWyhhYCoJ

— Lauri Myllyvirta (@laurimyllyvirta) May 4, 2021

Other countries have made recent announcements that relate directly to climate policies. Japan, comfortably Australia’s top customer for thermal coal exports, saw its top coal power producer cancel the construction of a coal plant in Yamaguchi Prefecture. Kanden Energy Co. also announced an abandonment of a new coal plant in Akita, meaning there are no plans for any new coal plants besides those that have already begun construction. These announcements both came as Prime Minister Yoshihide Suga announced a new 2030 target of 46%. That puts Australia’s gas exports to Japan in the firing line, too.

And while South Korea is not as significant a customer of coal, attitudes towards the fuel are rapidly darkening, with a significant new announcement made at Biden’s climate summit that the country is halting the “state-backed financing of coal-fired power plants overseas”, and is due to issue a strengthened 2030 target in the coming months. The Asian Development Bank just announced they’re planning an exit from coal finance, supporting a coal exit across all of Asia, just as a major Malaysian bank recently announced too.

That leaves Taiwan and India as Australia’s only two key fossil export customers not having announced increases to their climate ambitions in the past few weeks – but there is still plenty of time left in 2021.

A decent proportion of Australia’s domestic emissions actually come from the process of extracting fossil fuels and preparing them to sell to other countries. That means if Australia’s fossil exports are forced to wind down due key customers quitting coal and gas, Australia’s domestic emissions will fall far faster than expected.

This quickening drumbeat of Asian fossil fuel shifts comes as Australia formalises its program of heavy government subsidies for the gas industry. $58.6m AUD is being announced this week as part of this week’s budget. \

'National Gas Infrastructure Plan':

🏭No mention of emissions, climate change.

🏭No mention of industrial electrification.

🏭"Solutions" all assume more gas.

🏭Minor residential demand reduction in only one scenario.

🏭Rejects AEMO's 'baseline' for apparently no reason. pic.twitter.com/nvC1nNwfXc— Tom Swann (@Tom_Swann) May 7, 2021