AGL Energy is to lose the head of its new energy division, Marc England, in what could be a setback to that company’s efforts to make sense of the new, evolving distributed energy market.

England, who was hired in July 2013 as head of strategy before being asked to head the division looking at new technologies such as rooftop solar, battery storage and electric vehicles, has been poached by the New Zealand’s Genesis Energy to be its chief executive.

England will stay in his current role until the end of April to ensure a smooth transition, with Alistair Preston, currently the head of organisational transformation, to run the division on an interim basis.

England built up a team of 250 people, employing many of them from outside the traditional utility space as he sought new ways to think about how the new technologies that might be adopted by consumers, and how to integrate them into a decades-old business model.

England’s new energy division was given equal ranking by new chief executive Andrew Vesey with the existing operations – including the massive generation fleet, Australia’s largest, and its extensive retailing operation.

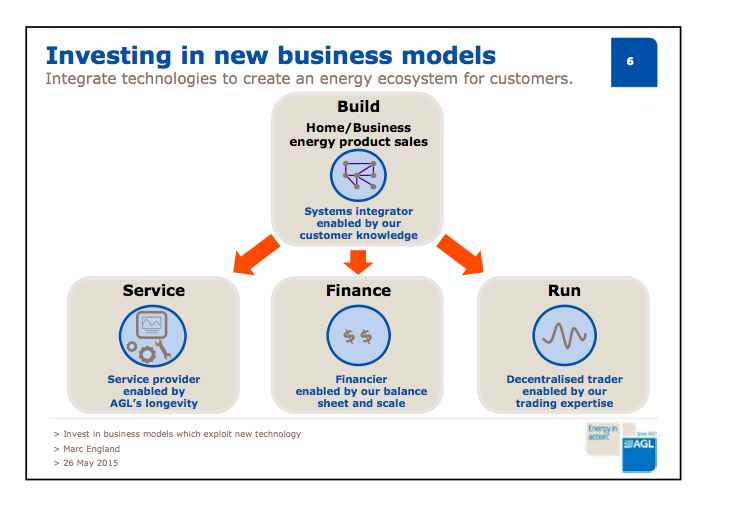

But finding that new business model is proving challenging for a company also seeking to protect that generation fleet, which is not only the largest in Australia but also the biggest emitter.

Vesey conceded last week that the arrival of new technologies such as solar, battery storage and the “internet of things” meant it was unclear what exactly the new business model would be – other than the fact that it would be completely different to what exists now.

AGL said England had “successfully established the company’s New Energy group as the preeminent provider of distributed energy services.”

It said the group currently employs 250 people who engage in rooftop solar, battery storage, digital meters, electric vehicles, home energy management, commercial electrical & thermal solutions and demand response initiatives.

AGL planned to achieve one million “smart” connections by 2020 and wanted to be one of the leading providers of energy storage and home energy services. It aimed for 600GWh of rooftop solar, and $400 million in revenue from the new energy division by 2020.

Morgan Stanley said it viewed the departure of England as “a slight negative” for the implementation of AGL’s New Energy commitments.

England, speaking last year at the Disruption in Energy conference hosted by RenewEconomy, talked of the range of market forces impacting the traditional energy sector. This included the need to reduce emissions, the falling cost of distribute energy, the growth of connectivity and data, and the electrification of homes and vehicles.

“Our traditional industry is used to providing two products, gas and electricity,” he said. “We’re going to have to get used to a different approach.”

At Genesis, England will encounter a completely different market. Genesis, the country’s largest gas and electricity retailer, is looking to phase out its last coal-fired plants – and the country’s – by 2018.

But in New Zealand, the uptake of distributed generation is much lower than it is in Australia, although Genesis is now looking at distributed energy.

In October, it announced it would conduct a residential energy storage trial with Enphase Energy for it energy storage system that includes the Enphase AC battery and monitoring systems to control and monitor the output from rooftop solar systems.

Before England joined AGL as group head of strategy, he had roles at British Gas and Ford, and originally worked as a petroleum engineer at Halliburton Energy Services in Oman.

Genesis says England’s upstream oil and gas will be helpful, particularly in light of its stake in the Kupe oil and gas field.