- Modelling indicates the ‘highest clearing price’ for ACCUs grew to around $14 at the third ERF auction – a 40 per cent premium on the average price of abatement ($10.23) published by the Clean Energy Regulator (Regulator).

- This reaffirms that the weighted average price ($10.23) is not representative of broader abatement value being contracted, with informed bidders continuing to extract full value by balancing risk/returns in line with ACCU supply expectations.

- We estimate ACCU prices may push higher at ERF auction IV, with potential for lower participation and reduced competition to enable marginal participants to exert greater influence at the top end of the supply curve, pushing prices higher.

- Higher prices are likely to be supported by secondary market activity, which may again act as a de facto floor price at ERF IV.

RepuTex today released its statistical review of the third Emissions Reduction Fund (ERF) auction, including our simulated back casting of proponent bids, our auction supply curve, and our estimated highest clearing prices, i.e. the last (or highest) point at which contracts were cut-off in line with the Regulator’s benchmark price and variable volume threshold.

The third ERF auction was held on the 27th-28th of April 2016, with 73 contracts entered into by the Regulator for the delivery of 50,471,310 ACCUs. Approximately $516 million (M) in funding was committed (20 per cent of all ERF funding), at an average price per tonne of $10.23.

While the average price of abatement disclosed by the Regulator ($10.23) is a market reference point, in practice, it is of little help as a robust price signal in that it does not reflect the wider value of contracted emissions reductions. Nor does the average contract price reflect the current value of ACCUs – and in this way, should not be mistaken for a market-derived “carbon price”.

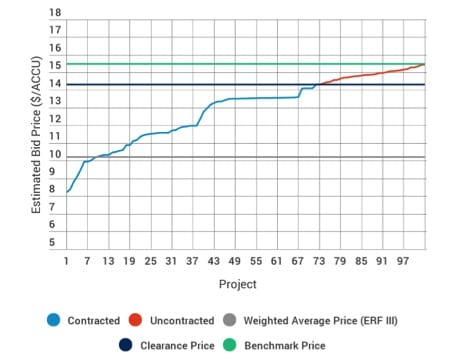

As shown in Figure 1, RepuTex modelling indicates the ‘highest clearing price’ for ACCUs grew to around $14 at the third ERF auction – a 40 per cent premium on the average price of abatement ($10.23) published by the Regulator. This reaffirms that the weighted average price is not representative of broader abatement value being contracted, with informed bidders continuing to extract full value from the ERF by balancing risk/returns in line with ACCU supply expectations, and understanding the impact of supply volumes on the ‘safe bidding range’.

So why the lower average price at ERF III?

The weighted average price was heavily influenced by a small number of large bidders, in particular the ‘mega project’ developed by Terra Carbon and the Queensland government under its Catchment Conservation Alliance, contracting 15 million credits , or 30 per cent of credits contracted at the auction. Findings indicate that these large projects dragged down the weighted average price. To this end, the weighted average price was heavily influenced by the bid price of one large project.

As above, this dynamic reaffirms that the weighted average price is not representative of broader abatement value, with bidders continuing to extract considerable upside from ERF auctions. Figure 2 represents the value range extracted by bidders at each ERF auction. The high point of the range represents our estimated “highest clearance price” – i.e. the point at which the highest contract price was entered into prior to the auction cut-off – where the low point represents the weighted average price disclosed by the Regulator.

Analysis indicates the value being contracted above the average price of abatement within each auction, however, pricing dynamics remain unique to each auction event, and suggesting prices again will remain subject to the unique supply and bidding behaviour of each auction. In other words, backcasting of prices is of little benefit to assessing future ACCU prices, with the competitive dynamics of each auction – i.e. supply volumes and participation – contributing to bidder behaviours and ultimately informing the shape of each supply curve/bid-stack that we see in Figure 1.

Bullish outlook for ACCU prices at ERF Auction IV

As noted in our earlier updates, we continue to see potential for ACCU prices to push higher at ERF IV, driven by lower participation and reduced competition. This trend is likely to be reinforced should the participation of mega projects recede, with the average price likely to increase. In parallel, remaining marginal projects may have an opportunity to exert greater influence at the high end of the auction bid-stack, pushing prices higher.

Higher prices are also likely to be supported by secondary market activity, with initial trading taking place ahead of ERF III as speculators with existing ERF I and II contracts sought to acquire cheaper ACCUs to hedge their delivery volumes. Initial trading took place at a notable discount to ACCU price expectations ahead of the auction.

Ahead of ERF IV, bullish sentiment may flow through to the secondary market, suggesting we may see secondary prices influence bidder behaviour at the next ERF auction, creating a de facto floor price.

Subsequently, dynamics such as lower competition, the role of large proponents, the emergence of a secondary market, and an implied price floor suggests ACCU prices may trend upwards at ERF IV. As always, the importance of proponents understanding the evolving ACCU supply pipeline for each auction, and the role of large projects and market dynamics is not to be underestimated, with these factors determining the shape of the auction bid stack, and therefore driving market prices.

RepuTex is Australia’s largest provider of energy and emissions market analysis. This article was originally published under RepuTex’s Research Insights service. To view the full article please click here.