Trina Solar – one of the biggest solar PV manufacturers in the world – has reported a 50 per cent jump in module sales in Australia in the second quarter, and appears on track for a similar jump over the year.

The data from Trina Solar is interesting because Trina holds the number 1 spot in the Australian market, with a market share of more than 10 per cent – a position that chief finance officer Terry Wang says it continues to hold. So either Trina Solar is lifting its market share, or the Australian solar market is experiencing more robust growth than thought.

Trina Solar overnight released its second quarter results (see first graph) which showed a 50 per cent jump in sales to around $US24 million in the second quarter from the first quarter.

That is largely explained by seasonal patterns, but over the first half, the total sales for Australia appear to be $US41 million in 2013, compared to around $US31 million in 2012. Given that the $A has fallen against the US currency in the past year, the difference in local sales values is likely to be more pronounced.

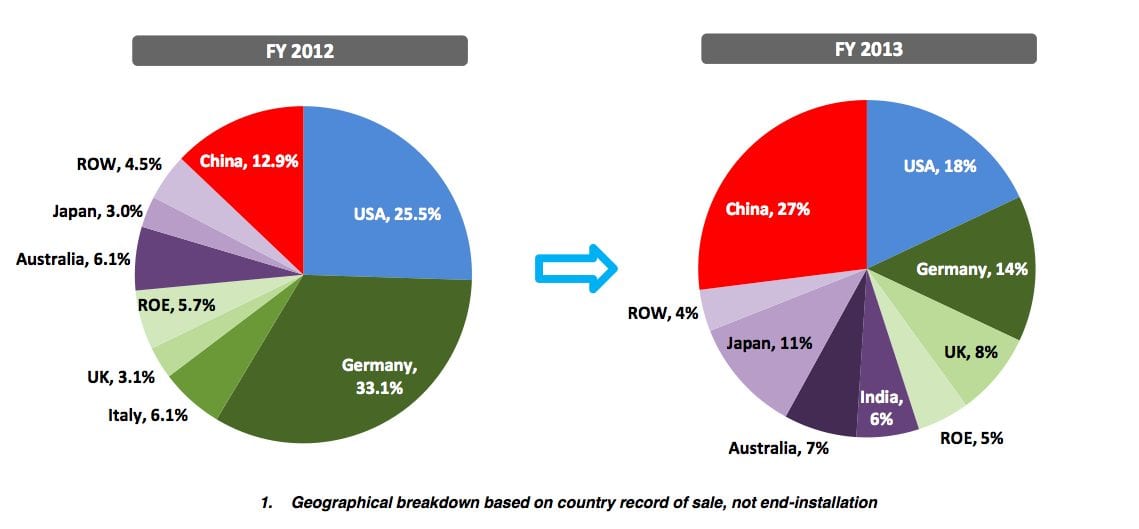

The second graph – showing anticipated global sales for the 2013 calendar year, compared to 2012 – shows that Australia still represents a significant part of Trina Solar’s global market – despite the surge in China, India and Japan.

Trina Solar has upgraded its shipment forecasts for the whole year by around 10 per cent to between 2,300MW and 2,400MW. Australia is expected to account for 7.1 per cent of that – or around 150-160MW.

This compares to 6.1 per cent of the 2012 shipment total of 1,600MW – or around 100MW for the Australian market in 2012. Wang noted in an analysts call that the company continued to get a premium price for its product in Australia – as a result of its market position – although premiums were strongest in Japan.

Trina Solar’s global results were notable for the strength in the Chinese and Japanese markets. The Japanese market is expected to triple in size, China shipments are expected to more than double, and the US market is also showing growth.

The company also recorded an improvement in margins and a smaller loss of $US33.7 million. Notably, the company recorded another fall in production costs “in the high single digits”, and sale prices had stabilised.