Higher electricity bills and a missed renewable energy target: That would be the most likely outcome if Australia’s carbon price was repealed, according to a new study commissioned by the WWF.

The report, prepared by carbon and energy research firm RepuTex, investigates the likely impact on Australian renewable energy development and retail electricity prices should Tony Abbott’s Coalition win the September election and makes good on its repeated pledges to scrap the Labor government’s carbon pricing mechanism.

The study finds that, if this does happen, the price of Large-scale generation certificates (LGC) would rise to near the effective penalty price of A$85/MWh (the price of not purchasing a credit), thus making the development of renewable energy assets uneconomic.

This, in turn, would see investment in renewable energy slow – particularly for wind energy, according to the report – potentially resulting in a capacity shortfall of nearly 6GW; meaning that by 2020 only 14 per cent of Australia’s energy would come from renewables – well short of the 20 per cent RET.

Meanwhile, without the additional competition from wind energy or the other benefits of icreased uptake of renewables – such as rooftop solar – the report says we would likely see a rise in retail electricity prices.

“Repealing the (carbon price mechanism) and returning to previously low wholesale electricity prices would stifle clean energy development and favour generation from existing coal-fired generation assets,” says the report. “The lack of pricing support would generate only 14 per cent of electricity from renewable resources. While wholesale prices would be lower, retail customers would be unlikely to receive the benefit of these lower wholesale prices, as electric providers would continue to pay for the LRET scheme as required by the penalty price.”

RepuTex’s findings are in line with those of BNEF, who last week warned that cutting the renewable energy target would lead to an increase in electricity bills for consumers, not a reduction.

“Our analysis indicates that a reduction of the Renewable Energy Target is unlikely to result in a cost reduction to the end consumer,” BNEF Australia head Kobad Bhavnagri, said in emailed comments to RenewEconomy last week.

“By contrast, it could actually put upward pressure on retail electricity prices. This is because the savings from reducing the target are outweighed by the costs.”

Similarly, says WWF-Australia climate change manager Kellie Caught, the RepuTex report finds that repealing the carbon price would have a double whammy impact: “a big drop in renewable energy projects, meaning more pollution, and higher electricity prices for consumers.”

Alternatively, the modelling suggests that with carbon pricing in place, even at low prices, the LGC market would continue to support the development of 7GW of onshore wind energy at LGC prices between $40-75/MWh, achieving close to the 41,000 GWh RET target by 2020.

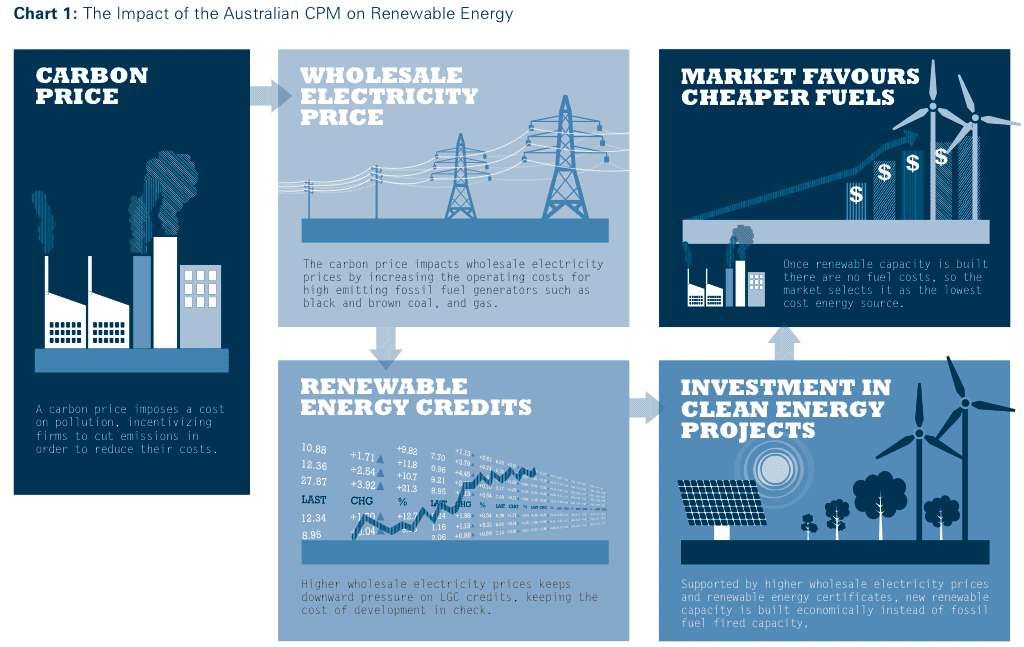

“Putting a price on pollution supports renewables in two ways,” said Caught. “First, it provides a long-term price signal to investors to favour the build-up of low polluting energy like wind and solar, and second it works with the Renewable Energy Target (RET) to help reduce the cost of building new renewables, particularly the cost to customers.

“Putting a price on pollution supports renewables in two ways,” said Caught. “First, it provides a long-term price signal to investors to favour the build-up of low polluting energy like wind and solar, and second it works with the Renewable Energy Target (RET) to help reduce the cost of building new renewables, particularly the cost to customers.

“WWF is urging all parties contesting the upcoming election to include a price and limit on pollution, like an ETS, as part of their climate change policies and commit to stronger pollution reduction targets,” Caught said.